By Penguin accounts. ·

Customers above the threshold

limit will be able to follow the MTD guideline through Penguin Accounts ·

All the VAT postings are

maintained digitally as expected and the VAT return shall be submitted

electronically via the APIs to HMRC system from Penguin Accounts ·

Penguin accounts updates HMRC via the APIs directly. ·

The MTD VAT APIs allow Penguin

accounts to supply business financial

data to HMRC, so that clients can fulfil their

obligations. ·

The authorization tokens will be

handled securely. This document explains the process of submitting the VAT

returns to HMRC via PenAir. Online filing of VAT MTD

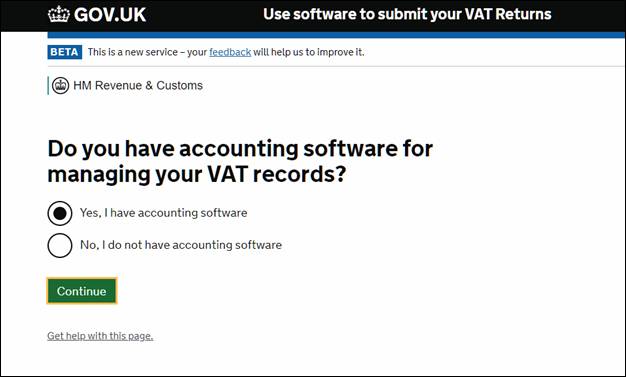

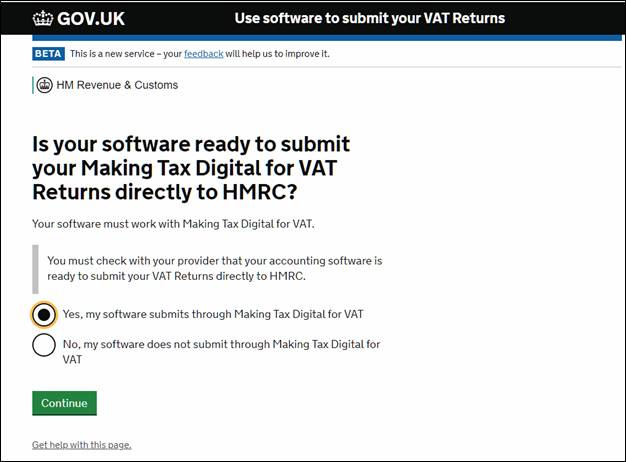

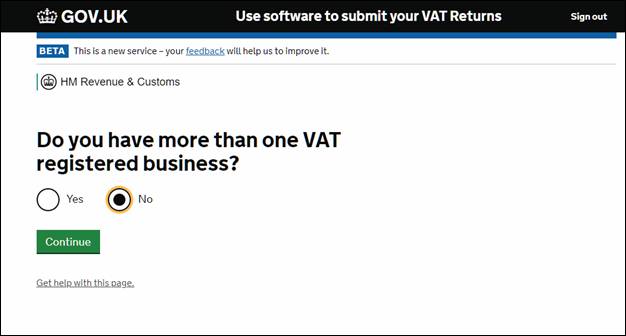

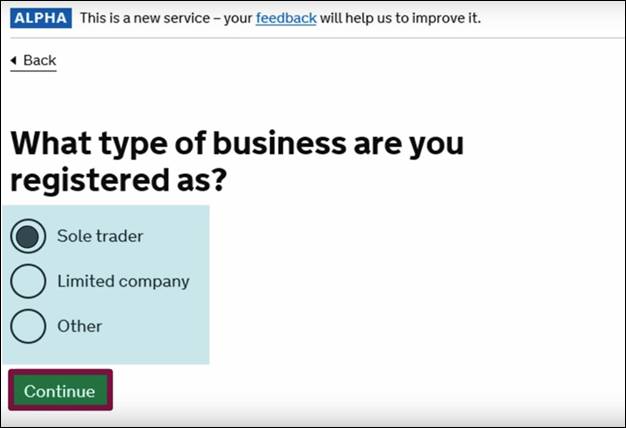

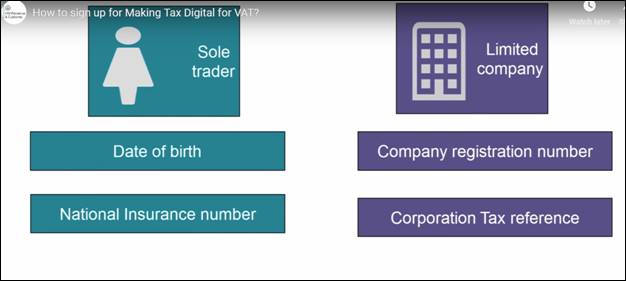

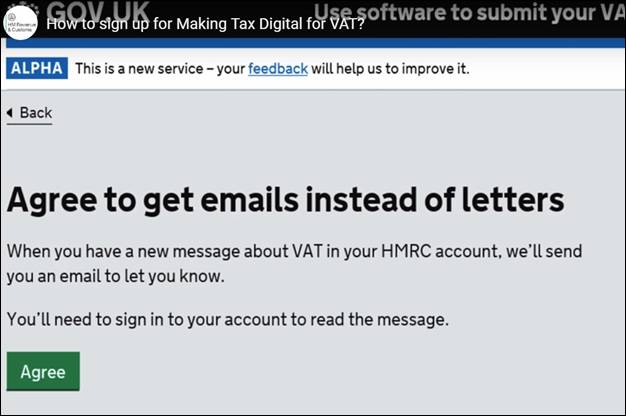

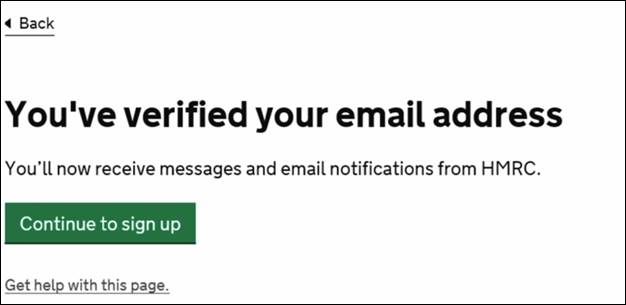

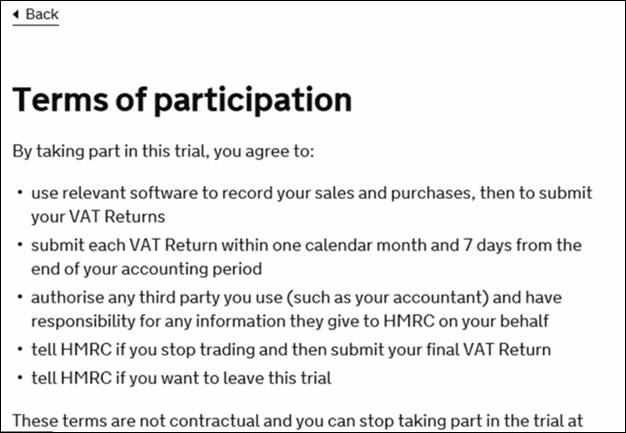

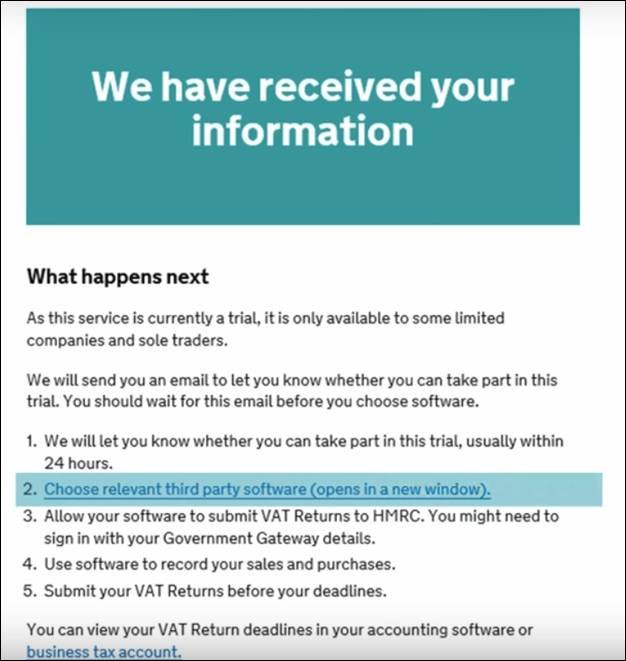

( Making Tax Digital ) was introduced by HMRC from 1st April 2019. Following steps should be done to file VAT electronically. Step

1: Sign up for MTD with HMRC Step

2: Complete VAT settings in Penguin accounts. Step

3: Submit your VAT. Step 1 : Sign up for MTD with HMRC. Make sure

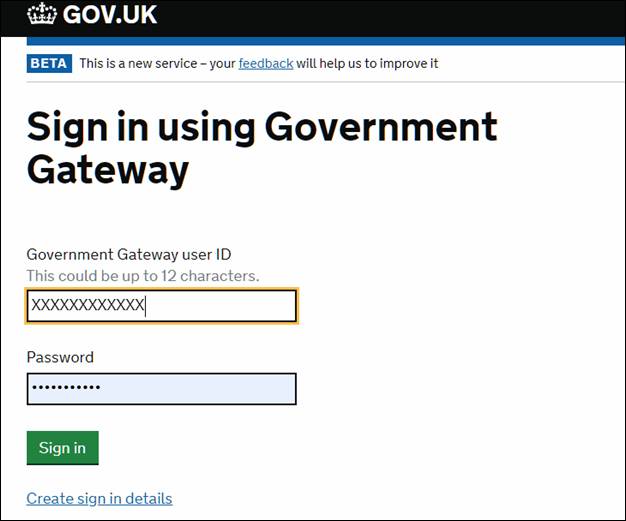

you have your government gateway id, to sign up. Click the

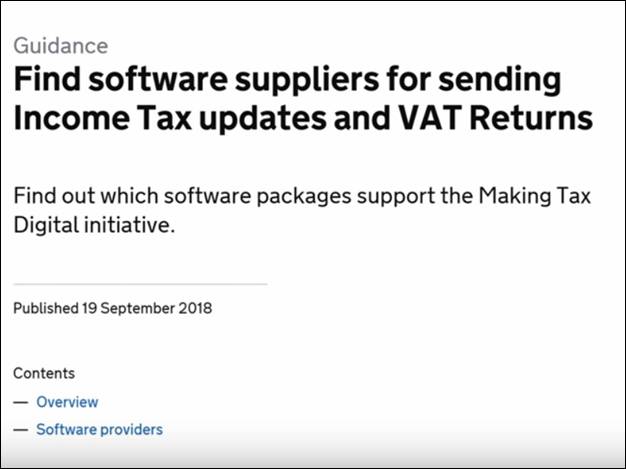

below link to start the process. https://www.tax.service.gov.uk/vat-through-software/sign-up/have-software You can skip the below step since you are already using

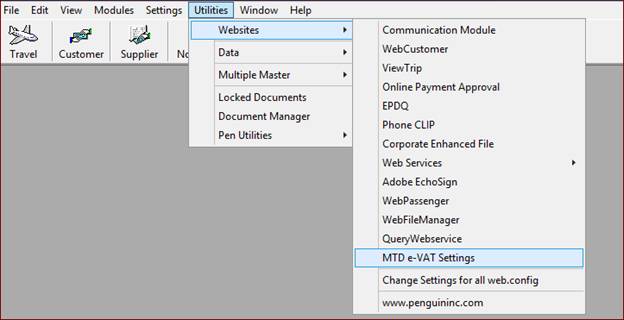

Penguin. Step 2 : Authorize

penguin to file MTD A

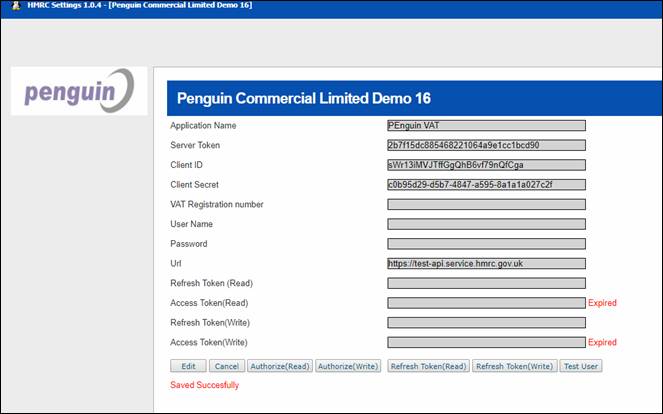

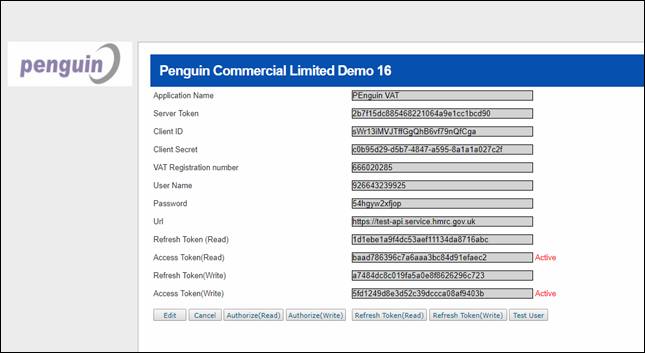

sample URL for Settings in PenAir Demo https://penguindatacentre16.pensupport.co.uk/PenAIR/Penairdemo16/HMRCTEST/HMRCLoginForm.aspx 1. Save the mandatory fields given below a)

Application name b)

Server Token c)

Cline Id d)

Client Secret e)

URL And save by clicking “Save” Button

Set the Redirect URL in HMRC

Account After saving , Click on “User” Button to create a test user.

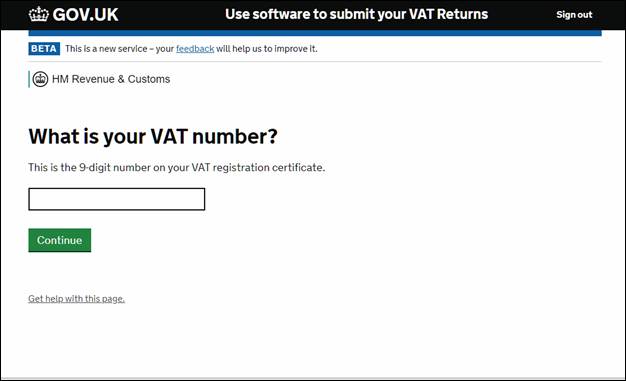

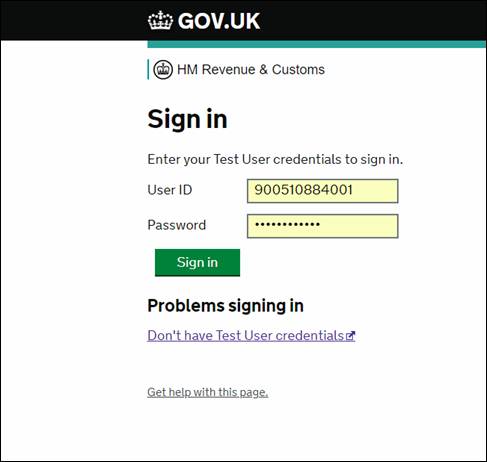

Then we will get VAT Registration number, User Name, Password. Then Click on “Authorize(Read)”. It will redirect to

HMRC website on another tab.. There we must enter the username and password that we get

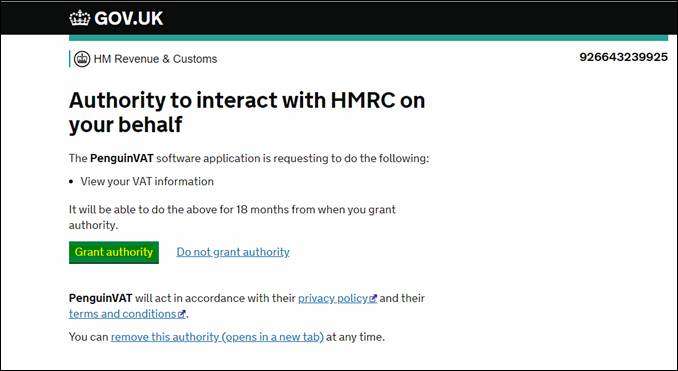

from step 1 and click “Grant Authority” button in HMRC Website. Then you will get the Access

token and Refesh Token for

“Authorization(Read)”. Similiarly, Authorize “Write” and you will get Access token and Refesh Token for “Authorization(Write)”. Now you have all the credentials for

submitting VAT. The Access

token will expire in 4 hours. If expired, click on Refresh token, so that the

access token will be refreshed. For the VAT RETURN SUBMISSION FROM PENAIR, please refer the help file for. → HMRC

MTD online filing process

Copyright © 2003-2020 Penguin Commercial Limited.